By Peter Tchir of Academy Securities

Fed Week? Animal Spirits?

While many are assuming the July 30th FOMC meeting is a “no-go” and the first rate cut isn’t likely until the September 17th meeting, that could be wrong. We will also touch on “Animal Spirts” in this report, as that will be the next driver for the economy, even more than the markets.

But first, let’s revisit Academy’s Geopolitical content this week.

Digesting that information is enough, and we could almost stop here, but we want to reiterate our views on the Fed/rates and introduce our take on Animal Spirits.

Could This Week Re-Shape the Fed Narrative?

We get a LOT of jobs data this week. In Getting The Fed to Get Ahead we argued that any “good” data had elements that went against the “good” narrative and that “bad” and even “ugly” data abounded.

Nothing since we wrote that piece gives us any reason to assume the jobs data is better. Sure, the Establishment Survey Headline Number might beat again. This would defy statistical probability that so many economists with vast resources who forecast the number are wrong (only to be proven correct down the road when all the revisions hit). However, there is a real risk that the data is very disappointing (including our ongoing concerns about how seasonal adjustments are calculated).

Spending disappointed and even with relatively tame “whisper numbers,” the risk remains to the disappointing side on jobs data.

We also mentioned why we think the Fed’s inflation concerns related to tariffs are overstated in that report.

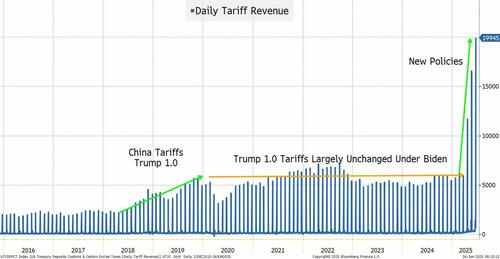

On Thursday, we added more arguments against the Fed’s overly cautious tariff inflation concerns in the Tariff Revenue Chart.

We fully expect the market to agree with our take by the end of this week’s data and news cycle.

Own Duration

We continue to like owning duration. Clearly everything we describe above (and our outlook of 3 to 4 cuts this year, potentially starting in July) supports that trade. In the aforementioned tariff chart, we highlight the revenue being generated by tariffs and why this is good for lowering bond yields.

There was recently some discussion about “dramatically scaling back the issuance of notes and bonds issued by the Treasury Department.”

While we paraphrase a bit here (maybe a lot) there are some signs the administration may decide the Fed is wrong, yields are too high, and that they will issue only short-dated obligations!

If this idea gains traction, look for curves to flatten and duration to outperform (and this is only in addition to all the other reasons why we have liked it).

Sure, at 4.27%, 10s are not the “screaming buy” they were a few weeks ago, but they should drift toward 4.1%, with a lot of catalysts out there that could force any remaining shorts to cover.

Animal Spirits

With U.S. stocks at all-time highs, we have seen animal spirits impact investors. It is unclear how much they have hit corporate America, or even the American consumer.

The market can continue to do well if the administration can unlock animal spirits in the economy. We seem to be on the cusp of that.

Markets will need the “Animal Spirts” they have already exhibited to be picked up by the economy. There are plenty of reasons to believe that could occur, with tariff policy probably being the biggest threat (it shouldn’t be, but as we saw on Friday afternoon, it could be).

Bottom Line

The data on jobs, and the narrative on inflation this week, should heavily influence the Fed at the end of the month.

Re-awakening animal spirits across the economy is probably necessary to justify current market levels, but this will depend on which direction the administration heads in on several fronts. Currently, they seem to be leaning towards steps that go towards changing caution to excitement.

Have a great weekend and thank you for allowing Academy the opportunity to help you navigate these incredibly tricky times.

Source link