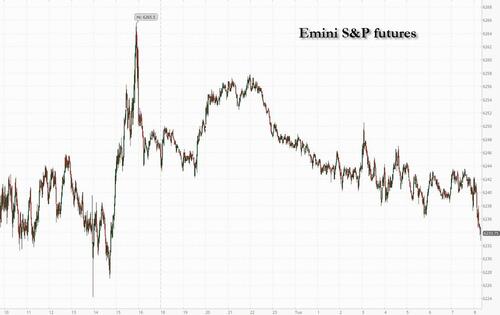

US equity futures - which closed at a fresh all time high after the best quarter since 2023 put them in extremely overbought territory - are weaker, dragged by Tech as TSLA is -5% pre-mkt on Musk vs Trump part 2. Pre-mkt, the balance of Mag7 is mixed with Staples outperforming. As of 8:00am, S&P futures are down 0.2% following two successive closes at all-time highs as sentiment remains linked to progress of trade negotiations and the fate of President Trump’s tax and spending bill, which the Senate has failed to pass. Nasdaq futures also drop 0.3% while European stocks also fell. Bond yields are lower as the curve flattens with USD continuing to decline, setting another 52-wk low. As discussed yesterday, the dollar had its worst H1 since 1973 while SPX has its best quarter since 23Q1. Commodities are weaker although gold is soaring. Today is the first piece of the labor market puzzle with JOLTS but we also receive ISM-MFG and vehicle sales. Powell speaks at 9.30am. The voting process on the tax/budget bill continues.

In premarket trading, Tesla falls 5% after President Donald Trump lashed out at Elon Musk, accusing the Tesla and SpaceX chief executive officer of benefiting excessively from government subsidies for electric vehicles.Other Mag7 stocks are mixe ( Apple +0.4%, Amazon +0.05%, Alphabet -0.03%, Meta -0.01%, Microsoft +0.07%, Nvidia -0.7%). Here are some other notable premarket movers:

Until this morning, stock bulls had seized control of a market that was rattled by Trump’s trade overhaul, a war in the Middle East and persistent uncertainty over growth and inflation. Yet unpredictability persists, with US trade talks racing toward a July 9 deadline and Trump pushing to finalize a budget that’s projected to add more than $3 trillion to the US deficit over the next decade.

“We’ve had a strong quarter, but there’s still too much on the table,” said Haris Khurshid, chief investment officer at Karobaar Capital. “If the trade talks drag or the tax bill stalls, we’ll see how much conviction these bulls really have.”

Trade talks hit a snag after Japan said it would not sacrifice its agricultural sector as part of its tariff talks with the United States, after President Donald Trump complained that the key Asian ally was not buying American rice. That won't help Japan's auto sector which is already reeling amid widespread cost cuts to remain competitive in the US market.

As discussed yesterday, Goldman's flow gurus noted the S&P 500 will add to its rally this month before losing steam into August. “We are entering the strongest month for the S&P historically,” they said, noting that the first two weeks of the months are traditionally the best span of the year for stocks.

While economists are widely expecting Trump’s tariffs to drive inflation higher, subdued price growth so far has cast doubt on that view, emboldening the White House and increasing its pressure on Jerome Powell. Although the Fed has so far held off on cutting interest rates, two governors have recently publicly diverged from Powell, suggesting a reduction could be appropriate as early as July. Swaps imply at least two quarter-points of monetary easing by the end of the year, with an about 65% chance of a third cut by December.

“The bulk of the market sees July as a live meeting, that’s limiting the dollar,” Geoffrey Yu, a strategist at Bank of New York Mellon Corp., told Bloomberg TV. “Going back to the other asset classes, the fact that July is live and we may get two cuts at least this year, that is underpinning risk sentiment as well.”

Powell and other top central bankers are set to discuss monetary policy at the European Central Bank’s annual retreat later on Tuesday in Portugal. Also on investors’ radar is a slew of economic data, including a wave of PMI readings and the US job openings report ahead of Thursday’s nonfarm payrolls.

“On balance, we see the environment as constructive for risky assets,” noted Mohit Kumar, chief European strategist at Jefferies International. “But with positioning moving to the long side, we do not see a sharp rally but a slow grind higher in risky assets.”

Europe's Stoxx 600 falls 0.3%, with media and auto shares among the biggest laggards. In individual stocks, Umicore shares rise after the firm boosted its Ebitda guidance. Here are the most notable European movers:

Earlier in the session, Asian equities advanced, after halting a four-day rally Monday, as Taiwan saw a strong rebound and South Korean stocks climbed. The MSCI Asia Pacific Index rose 0.4%, putting the index on pace for its highest close since September 2021. Shares of TSMC, Hon Hai and Reliance Industries contributed the most the benchmark’s gains. Taiwanese stocks jumped on a tech rally and bounce in the local currency. Singapore’s Straits Times Index was on pace for a record high. Holding companies helped drive gains in Korea on optimism that legal revisions will be approved this week to help speed corporate reforms.

In FX, the Bloomberg Dollar Spot Index falls 0.4% to the lowest since March 2022 while perceived safe-haven assets outperform, as investors monitor progress on trade talks and wrangling in Washington over President Donald Trump’s tax bill. The yen is leading gains against the greenback in the G-10 sphere, rising 0.8% with the Swiss franc not far behind. The euro is on the verge of its longest winning streak against the greenback in more two decades. The common currency gained as much as 0.4% to $1.1829, and a higher close would extend its rally to a ninth straight day, the longest stretch since 2004.

In rates, treasuries extend Monday’s advance, with yields falling by 2bp to 4bp across tenors, led by euro-zone bonds after ECB’s Martins Kazaks said significant gains for the currency could warrant another rate cut. US yields are lowest since early May, the 10-year under 4.19% for the first time since May 1 but trailing steeper drops for UK and German counterparts. European bonds also advance, led by longer-dated maturities. UK and German 30-year yields fall 6-7 bps each. Gilts got a boost after Bank of England Governor Andrew Bailey said they are looking at the possibility of offloading fewer government bonds over the coming year. A long list of ECB speakers provided few surprises while euro-area inflation rose as expected and was also largely ignored. Among Tuesday’s events are a global monetary policy panel in Sintra that includes Fed Chair Jerome Powell.

In commodities, oil prices are steady with WTI near $65 a barrel; spot gold climbs $40 to around $3,344/oz.

Looking at today's calendar, US economic data slate includes June final S&P Global US manufacturing PMI (9:45am), June ISM manufacturing, May construction spending and May JOLTS job openings (10am) and June Dallas Fed services activity (10:30am). Fed speakers are limited to Powell’s Sintra panel (9:30am), which also includes BOE Governor Andrew Bailey, ECB President Christine Lagarde, BOJ Governor Kazuo Ueda and Bank of Korea Governor Chang Yong Rhee

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the new quarter mostly higher, albeit with gains capped amid this week's busy data calendar and with underperformance in Japan owing to recent currency strength. ASX 200 treaded water with the index just about kept afloat as strength in defensives offset the losses in the mining and materials sectors. Nikkei 225 underperformed as exporters suffered the ill effects of recent currency strength and with the predominantly better-than-expected BoJ Tankan survey increasing the scope for a more hawkish BoJ, while US President Trump also noted they will be sending Japan a letter regarding tariffs after not accepting US rice. Shanghai Comp edged mild gains after Chinese Caixin Manufacturing PMI topped forecasts with a surprise return to expansionary territory, although the upside was limited for Chinese markets amid the holiday closure in Hong Kong and the absence of Stock Connect flows.

Top Asian News

European benchmarks began the day in the green, though futures were drifting into the open and this trajectory has increased since, Euro Stoxx 50 -0.5%. Specifics behind the move somewhat light, potentially a function of a modest pullback from recent gains and as markets look to the first very busy day of a front-loaded week. Sectors mixed, at the top of the pile we have Utilities, potentially boosted by the European heatwave and soaring demand for A/C.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Welcome to the second half of 2025. If you were in the UK or large parts of central or southern Europe last night, and without air con, I suspect you'll be feeling the same as me this morning. Exhausted, hot and bitten all over!! Never have I been looking forward to the small amount of rain on the forecast tomorrow as much.

As it’s the start of the month, Henry will shortly release our usual performance review covering the month and quarter just gone. If you'd have told me on April 8th, when the S&P 500 was already around -12% in the first week of the quarter, that it would ultimately end up +10.94% at the end of the three months in total return terms, I would have probably asked you if you needed to sit down and have a warm, cold or stiff drink to compose yourself. It's easy to forget now that at the start of the quarter, the S&P 500 had its fifth largest two-day slump since WWII. Also noteworthy in Henry's piece is that the dollar posted its worst H1 performance since 1973. So the impact of events around Liberation Day has still left a big mark even with the big equity bounce.

It was fitting that the quarter ended on a positive note with the S&P 500 (+0.52%) seeing a third consecutive advance and a fresh ATH. Several factors powered the rally forward, but the main ones were growing optimism around US trade deals, along with continuing anticipation that the Fed would be cutting rates by year-end. So that helped spur a notably cross-asset rally, with US HY spreads (-2bps) closing at their tightest since early March, at 290bps, whilst the 10yr Treasury yield also fell -4.9bps to 4.228%.

In terms of the latest on trade, there’s just over a week until the 90-day reciprocal tariff extension runs out on July 9. But the mood music has been increasingly supportive, which has reassured investors that several deals are set to be announced beforehand. For instance, markets reacted to the news late-Sunday night that Canada would be rescinding its Digital Services Tax to advance its trade discussions with the US, with the aim of reaching a deal by July 21. And separately, Treasury Secretary Bessent said on Bloomberg yesterday that “there’s going to be a flurry going into the final week as the pressure increases”. We saw the first indications of this yesterday as Bloomberg reported that the EU is willing to accept a trade deal with the US that keeps the 10% universal tariff in place, as long as there are certain carve outs in key sectors. Additionally they are looking for quotas or exemptions for the higher levies in areas such as autos (25%) as well as steel and aluminium (50%). Meanwhile on Japan, President Trump threatened on social media that he would impose new tariffs on Japan after suggesting that the country was unwilling to import US made rice. So things are heating up ahead of next week but Trump has talked about the possibility of extending the July 9 tariff deadline, saying on Fox News on Sunday, that “I don’t think I’ll need to”, but that “I could, no big deal.” So for now at least, the market consensus is that we’re not going to see a huge shock next week, and it’s worth noting that given the 10% baseline has now been in place since early April, the baseline is a relatively high tariff rate anyway. One of the questions in the survey asks your view about how the July 9th deadline will pass so please feel free to answer the survey in the link at the top.

Elsewhere, the focus is very much on the US Senate right now, as the Republicans are still trying to pass the tax bill by the July 4 holiday. The deadline is still possible to achieve, but it’s proving politically difficult given the tight margins the Republicans have, and given that the House and Senate both need to pass the same version of the bill. Currently the Republicans have a 53-47 majority in the Senate, along with the tie-breaking vote, so they can afford to lose 3 votes. But Senator Rand Paul has said he’s a no, whilst Senator Thom Tillis has denounced the Medicaid cuts in the bill, and he announced over the weekend that he’d be retiring, so doesn’t have to worry about a primary challenge. So there’s not much room for manoeuvre among the remaining holdouts. In addition, the House still need to pass the Senate version, and the original version only passed the House by 215-214, so this is a very delicate balance to keep that coalition together. That said, from a market perspective, there’s not too much concern about the July 4 deadline, since the debt ceiling increase in the bill isn’t an issue until later in the summer. So, if the timing did slide, it would have little impact from a market point of view, and Trump himself said on Friday that the July 4 deadline was “not the end-all”.

Otherwise, there was growing anticipation about Fed rate cuts this year, which helped to propel risk assets higher. This came as the White House once again called on Fed Chair Powell and the FOMC to lower rates over 250bps. Indeed, the amount of cuts priced in by the December meeting moved up +2.5bps on the day to 66.6bps, the most since early May. So that supported a rally in US Treasuries, with the 10yr yield coming down -4.9bps on the day to 4.228%, whilst the 2yr yield fell -2.9bps to 3.72%. And with nominal and real yields coming down, that helped to lift equities, particularly in the more cyclical sectors. In addition, there was a late rally in the US session as Apple (+2.0%) announced that the company was considering using a third-party AI to back a new version of its virtual assistant Siri. The late rally from Apple and other AI-focused names saw the NASDAQ gain +0.47% after being unchanged just over an hour before the New York close.

Over in Europe, the focus is turning to this morning’s flash CPI print for the Euro Area. But before that, we had the country readings from Germany and Italy yesterday, which surprised on the downside. So in Germany, the EU-harmonised reading unexpectedly fell to +2.0% (vs. +2.2% expected), whilst the Italian reading remained at +1.7% (vs. +1.8% expected). That countered the upside surprise from France last Friday, and helped front-end bond yields to remain steady, with the 2yr German yield down -0.2bps yesterday. However, the long-end struggled across most of the continent, with yields on 10yr bunds (+1.5bps), OATs (+1.9bps) and BTPs (+0.3bps) all rising. It was a similar story for equities too, with the STOXX 600 down -0.42%.

The highlight in Asia is a trickier session for Japan after the trade news above. The Nikkei (-0.86%) is fighting back from deeper losses early but is down from a near one-year peak. A decent Tankan survey has also helped to strengthen the Yen. Chinese markets are either side of the flatline with Hong Kong closed today for a public holiday. On a positive note, the KOSPI (+1.13%) is leading gains in the region, buoyed by a near +2.0% rise in index heavyweight Samsung Electronics. S&P 500 (-0.11%) and NASDAQ 100 (-0.09%) futures are both edging lower.

Turning back to China, the manufacturing sector has returned to growth in June after a brief contraction in May, although overseas demand continues to decline amid ongoing external uncertainties. The Caixin manufacturing PMI increased to 50.4 in June, surpassing expectations of 49.3 and showing a significant rise from the 48.3 recorded the previous month. This data follows a recent government PMI report indicating that Chinese manufacturing activity contracted for the third consecutive month in June.

Elsewhere, confidence among major Japanese manufacturers has improved over the three months leading to June, as companies continue to uphold their optimistic long-term investment plans, even in the face of trade uncertainty. The headline index reflecting the business confidence of large manufacturers stood at +13 in June, an increase from +12 in March, and exceeding market expectations of a +10 reading. Additional details reveal that the large manufacturing outlook for the second quarter was recorded at 12.0, consistent with the previous figure of 12.0, and stronger than the anticipated 9.0. All this supports our out of consensus rate hike view for July but trade will be a bigger swing factor.

To the day ahead now, and data releases from the US include the ISM manufacturing for June, and the JOLTS report for May. Elsewhere, we’ll get the Euro Area flash CPI print for June, German unemployment for June, and the final manufacturing PMIs for June. From central banks, we’ll hear from Fed Chair Powell, ECB President Lagarde, BoE Governor Bailey, BoJ Governor Ueda, ECB Vice President de Guindos, and the ECB’s Elderson and Schnabel.

Source link