With the application of protective tariffs applied across the board by President Trump, many are proclaiming the age of Neo-Liberalism dead.

Neoliberalism was another name given to Globalization, and the intention was always toxic.

The notion was as simple as it was evil… Instead of producing for ourselves, the productive industrial powers of each nation state would be stripped down to dependent shells of their former selves. Under this program outlined by David Rockefeller’s Trilateral Commission, which literally took over the US government in 1973, the world would be now organized around a caste system of first, second and third worlds.

In this caste system, ‘first world’ nations were told to embrace a culture of ‘post-industrial’ consumerism without the means to produce for themselves.

Meanwhile, ‘second world’ nations were told to become cheap labor sweat shops who would be forced to remain too poor to consume those cheap goods they would now export to ‘first world’ consumers’. If they wished to receive IMF or World Bank ‘aid’, these second world nations would now have to accept adopting ‘conditionalities’ that would prevent them from building up large scale infrastructure as so many assassinated nationalist leaders had aspired to do for decades.

Finally, “third world” (typically dark skinned) nations were denied even the smallest benefits of factory sweat shops, and would instead be seen simply as resource extraction zones to be run by mineral cartels as vast slave plantations.

That was a model of social organization begun in earnest in 1971 when the US dollar was removed from the Gold Reserve system and fixed exchange rate to April 2, 2025.

The theories of Milton Friedman and Friedrich von Hayek were now applied in full force across the Trans-Atlantic as a ‘post-Keynesian’ dialectic where de-regulation, and open markets would now define the new world trajectory towards nation-stripping and power transfer into the hands of a small oligarchical class that would control all aspects of human life.

Meanwhile, “economic value” itself was literally redefined as merely financial services devoid of any reality. This loss of sense of value in reality literally transformed the economy of the trans-Atlantic into a time bomb built atop mountains of hyperbolically growing speculative bubbles that would be destined to pop.

While critics of tariffs and the nation state system (such as eco-Keynesian-globalist Jeffrey Sachs) scream and holler about the incompetence of this maneuver by President Trump, the fact is that during its 250 years of life, the only times the USA has successfully industrialized and increased the productive powers of labor has been due to the application of protective tariffs. Taking that same time frame into account, the same fact applies to literally every nation of the world. When unbounded free trade was the norm, industrial growth has diminished, speculation has increased, and empires have benefited through their ability to keep their victims underdeveloped, corrupt and poor.

The cold hard facts supporting my claim are found in myriad scholarly sources, not the least of which are Anton Chaitkin’s Who We Are: America’s Fight for Universal Progress volume 1 and vol 2, Michael Kirsch’s The Challenge of Credit Supply, and EIR’s American System Reports.

A recent lecture by historian Sam Labrier titled ‘Trump, Tariffs and Treason’ sketched the most thorough proof of the effectiveness of protective tariffs that I have ever seen, which I invite everyone to watch now:

That said, protective tariffs are not enough.

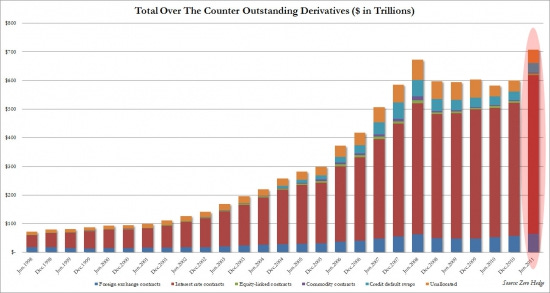

If the massive time bomb built into our trans-Atlantic banking system through the form of a $700 Trillion derivatives bubble is not quickly addressed, then these noble efforts to re-industrialize American industry will be for naught.

It is with this intention that I have decided to write the following short overview of America’s last battle against the Wall Street-City of London banks who orchestrated a major depression. How these same fascist-promoting banks went on after WW2 to create the Bilderberg Group and systematically destroy the very regulation that had kept them at bay will also be addressed.

Some Necessary Background

“The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.” – Franklin Delano Roosevelt, first Inaugural Address 1933

Knowing that the “money changers” had only been able to create the great bubbles of the 1920s via their access to the deposits of the commercial banks, Franklin Roosevelt made the core of his battle against the abuses of Wall Street centre around a 1933 piece of legislation entitled “Glass-Steagall”, named after the two federally elected officials who led the reform with FDR.

This was a bill that forced the absolute separation of productive from speculative banking, guaranteeing via the Federal Deposit Insurance Corporation (FDIC) only those commercial banking assets associated with the productive economy, but forcing any speculative losses arising from investment banking to be suffered by the gambler.

The striking success of this law inspired other countries around the world to establish similar bank separation. Alongside principles of capital budgeting, public credit, parity pricing and a commitment to scientific and technological development, a dynamic had been created that would express the greatest hope for the world, and the greatest fear for the financial empire occupying the City of London and Wall Street.

The death of John F. Kennedy ushered in a new age of pessimism and cultural irrationalism from which our society has never recovered. The destruction of a long term vision as exemplified by the space program, the St. Lawrence Seaway and the New Deal projects had resulted in a tendency within the population to increasingly look upon present pleasures as the only reality and future goods as the mystical expression of the sum of present pleasures.

In this new philosophical setting, so alien in previous epochs, money was permitted to act as a power unto itself for short term gains instead of serving the investments into the real productive wealth of society.

With this new paradigm shift into the “now”, a new economic model was adopted to replace the industrial economic model, which had proven itself in the years preceding and following World War II.

The name for this system was “post-industrial monetarism”.

This would be a system ushered in by Richard Nixon’s announcement of the destruction of the fixed-exchange rate Bretton Woods system and its replacement by the “floating rate” system of post 1971 fame. During that same fateful year of 1971, another ominous event took place: the formation of the Rothschild Inter-Alpha Group of banks under the umbrella of the Royal Bank of Scotland, which today controls upwards of 70% of the global financial system.

.

.

The stated intention of this Group would be found in the 1983 speech by Lord Jacob Rothschild:

“… two broad types of giant institutions, the worldwide financial service company and the international commercial bank with a global trading competence, may converge to form the ultimate, all-powerful, many-headed financial conglomerate.”

This policy demanded the destruction of the sovereign nation-state system and the imposition of a new feudal structure of world governance through the age-old scheme of controlling the money system on the one side, and playing on the vices of credulous fools who, by allowing their nations to be ruled by the belief that hedonistic market forces govern the world, would seal their own childrens’ doom.

All the while, geopolitical structures foreign to the United States’ constitutional traditions were imposed by nests of Oxford-trained Rhodes Scholars and Fabians who converted America into a global “dumb giant” enforcing a neo colonial program under a “Anglo-US Special Relationship”. The Dulles brothers, Rhodes Scholar George McGhee, McGeorge Bundy, Henry Kissinger, and Bush all represent names that advanced this British-directed plan throughout the 20th century.

The Big Bang

The great “liberalization” of world commerce began with a series of waves through the 1970s, and moved into high gear with the interest rate hikes of Federal Reserve Chairman Paul Volcker in 1980-82, the effects of which both annihilated much of the small and medium sized entrepreneurs, opened the speculative gates into the “Savings and Loan” debacle, and also helped cartelize mineral, food, and financial institutions into ever greater behemoths.

Volcker himself described this process as the “controlled disintegration of the US economy” upon becoming Fed Chairman in 1978. The raising of interest rates to 20-21% not only shut down the life blood of much of the US economic base, but also threw the third world into greater debt slavery, as nations now had to pay usurious interest on US loans.

In 1986, the City of London announced the beginning of a new era of economic irrationalism with Margaret Thatcher’s “Big Bang” deregulation.

This wave of liberalization took the world by storm, as it swept aside the separation of commercial, deposit and investment banking which had been the post-world war cornerstone in ensuring that the will of private finance would never again hold more sway than the power of sovereign nation-states.

After decades of chipping away at the structure of regulation that FDR’s bold intervention into history had built, the “Big Bang” set a precedent for similar financial de-regulation into the “Universal Banking” model in other parts of the western world.

The Derivative Time Bomb Is Set

In September 1987, the 20 year foray into speculation resulted in a 23% collapse of the Dow Jones on October 19, 1987. Within hours of this crash, international emergency meetings had been convened, with former JP Morgan tool Alan Greenspan introducing a “solution” that would have the future echoes of hyperinflation and fascism written all over it.

“Creative financial instruments” was the Orwellian name given to the new financial asset popularized by Greenspan, which were otherwise known as “derivatives”. New supercomputing technologies were increasingly used in this new venture, not as the support for higher nation building practices, and space exploration programs as their NASA origins intended, but would rather become perverted to accommodate the creation of new complex formulas that could associate values to price differentials on securities and insured debts that could then be “hedged” on those very spot and futures markets made possible via the destruction of the Bretton Woods system in 1971.

.

The growth of Derivatives that now number 10 times more than the entire world GDP in nominal value.

.

So while an exponentially self-generating monster was created that could end nowhere but in a meltdown, “market confidence” rallied back in force with the new flux of easy money. The physical potential to sustain human life continued to plummet.

NAFTA, the Euro and the End of History

It is no coincidence that within this period, another deadly treaty was passed called the North American Free Trade Agreement (NAFTA).

Speaking to the Los Angeles Times in 1993, Henry Kissinger (who had just been knighted by Queen Elisabeth II as a member of the Order of St. Michael and St. George for his service to the Empire) described NAFTA in the following terms:

“It will represent the most creative step towards a new world order taken by any group of countries since the end of the Cold War… The revolution sweeping the Western Hemisphere points to an international order based on cooperation… It is this revolution that is at stake in the ratification of NAFTA.”

With this Agreement made law, protective programs that had kept North American factories in the U.S and Canada were struck down, allowing for the export of the lifeblood of highly skilled industrial workforce to Mexico, where skills were low, technologies lower, and salaries lower still. With a stripping of its productive assets, North America became increasingly reliant on exporting cheap resources and services for its means of existence.

Again, the physically productive powers of society would collapse, yet monetary profits in the ephemeral “now” would skyrocket. This was replicated in Europe with the creation of the Maastricht Treaty in 1992, establishing the Euro by 1994, while the “liberalization” process of Perestroika replicated this agenda in the former Soviet Union. While some personalities gave this agenda the name “End of History,” and others “the New World Order”, the effect was the same.

In 1996, American economist Lyndon LaRouche presented his triple curve collapse function illustrating this process in its simplest terms, warning that if systemic interventions were not made, then the world economy would be irreversibly driven towards a hyperinflationary collapse akin to the 1923 destruction of Weimar Germany… except now on a global scale. Unfortunately, his words went unheeded at that time and the slide into insanity continued apace.

Click here to read the full article.

*

Click the share button below to email/forward this article. Follow us on Instagram and X and subscribe to our Telegram Channel. Feel free to repost Global Research articles with proper attribution.

Matthew Ehret is the Editor-in-Chief of the Canadian Patriot Review, Senior Fellow at the American University in Moscow, and Director of The Rising Tide Foundation. He has authored three volumes of the Untold History of Canada book series and four volumes of the Clash of the Two Americas. He hosts Connecting the Dots on TNT Radio, Breaking History on Badlands Media, and The Great Game on Rogue News. He writes at Matthew Ehret’s Insights.

Global Research is a reader-funded media. We do not accept any funding from corporations or governments. Help us stay afloat. Click the image below to make a one-time or recurring donation.

Comment on Global Research Articles on our Facebook page

Become a Member of Global Research

Source link