TSMC Arizona Base: A Strategic Manufacturing Hub Amid the U.S.-China Tech War

As of April 2025, TSMC’s wafer fabrication complex in Phoenix, Arizona has emerged as a focal point of the global semiconductor industry. With a total investment of $165 billion, this expansion represents one of the largest foreign direct investments in U.S. history, symbolizing TSMC’s strategic shift in response to geopolitics, technological sovereignty, and supply chain restructuring.

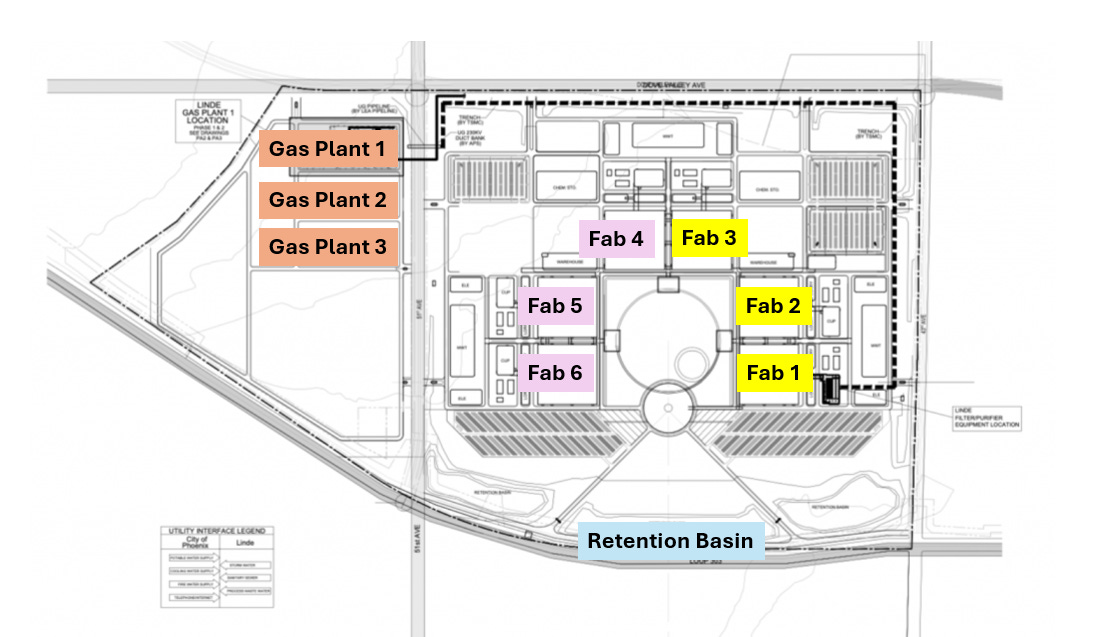

Located in North Phoenix and spanning over 1,100 acres, the site is planned to eventually house up to six fabs. As of now, three fabrication plants have been launched, accompanied by two advanced packaging facilities and one R&D center—collectively forming a full-scale semiconductor manufacturing ecosystem.

.

Click here for an enlarged view

.

The first fab (Fab 21 Phase 1) officially entered mass production in early 2025, using 4nm process technology to supply high-end SoCs for major clients such as Apple and NVIDIA. The second fab (Fab 21 Phase 2), originally scheduled for 2028, is being equipped with 3nm and 2nm process nodes. Due to surging AI chip demand, construction has been accelerated and equipment installation is already underway. The third fab (Fab 21 Phase 3) will adopt next-generation 2nm and A16 process technologies and is expected to break ground by the end of 2025, depending on U.S. government approval. There is also a possibility that Phase 3 may be converted into an advanced packaging facility to support backend needs for Phase 1 and 2.

.

.

Beyond infrastructure, TSMC’s Arizona base is catalyzing a new wave of industry integration. NVIDIA has already begun mass-producing its next-generation Blackwell AI chips at the site, partnering with Foxconn and Wistron to establish supercomputer manufacturing hubs in Texas. This collaboration is expected to generate $500 billion in AI infrastructure manufacturing value over the next four years. AMD has also announced plans to produce 5th Gen EPYC processor chips at the Arizona site—marking the company’s first use of advanced process nodes on U.S. soil and signifying a concrete step toward supply chain localization.

On the Economic and Employment Front

The project is expected to generate over 6,000 high-paying, direct tech jobs and create approximately 40,000 construction-related employment opportunities over the next four years. In total, it is projected to contribute more than $200 billion in indirect economic output across Arizona and the broader U.S. economy—making it a critical element in both regional development and America’s national semiconductor revitalization strategy.

However, challenges remain. Due to significantly higher construction, labor, and operational costs, semiconductor manufacturing in the U.S. is estimated to be at least 50% more expensive than in Taiwan. Additionally, a shortage of skilled technical workers has prompted TSMC to send more than 1,000 engineers back to Taiwan for training in order to support personnel development and facilitate operational handover in the U.S. Long-term integration of cultural communication and management styles will also be a subtle but important factor in ensuring smooth operations.

In summary, TSMC’s expansion in Arizona is not merely about increasing production capacity—it is a strategic response to global supply chain restructuring, explosive demand for AI-era chips, and the growing pressure from U.S.-China tech tensions to “de-risk” from China and Taiwan. This fab in the desert stands not only as a manufacturing site, but as a frontline outpost for semiconductor sovereignty and technological influence.

TSMC Expands Investment in the U.S. Semiconductor Industry

Under the U.S. government’s push for semiconductor self-sufficiency, TSMC has significantly increased its investment in the country. The establishment of its Arizona (AZ) wafer fabrication plant marks a critical step in reshaping the global semiconductor landscape. This move not only represents TSMC’s first advanced process node facility in the U.S. but also aligns with America’s strategic goal of securing its semiconductor supply chain.

As geopolitical tensions continue to impact the tech industry, TSMC’s Arizona plant is expected to become a key milestone in the U.S. semiconductor manufacturing strategy. This development will drive further competition, reshape industry dynamics, and accelerate the localization of semiconductor production.

Below is a comprehensive analysis of the U.S. semiconductor manufacturing supply chain, covering key players across upstream materials and equipment, midstream wafer fabrication, and downstream packaging and testing.

.

Click here for an enlarged view

.

The rapid rise of Arizona—particularly Greater Phoenix—as a new global hub for semiconductor manufacturing and innovation. Once home to Motorola’s early microelectronics efforts, the region now hosts a thriving ecosystem of chip giants like Intel, TSMC, NXP, and ON Semiconductor. TSMC’s Arizona campus, expected to produce chips by 2024, symbolizes this transformation with an estimated 4,500 employees. Intel continues to expand its presence, supporting next-gen technologies with over 11,000 workers. With its deep talent pool and research infrastructure, Arizona is evolving into the “Hsinchu Science Park of the U.S.” The state’s universities, especially ASU, are fueling this momentum with specialized campuses, innovation zones, and partnerships with industry leaders. Over 138,000 high-paying jobs in advanced manufacturing already anchor the region, while new projects in Tempe, Mesa, and Chandler further position Arizona as a strategic base for next-gen semiconductor production and R&D. As geopolitical factors drive localization, Arizona’s semiconductor boom exemplifies the reshoring of high-tech supply chains in the U.S.

On the April 17, 2025 earnings call, TSMC CEO C.C. Wei emphasized that the company is focused on its own operations and has not engaged in any discussions regarding joint ventures or technical collaborations with other companies—refuting rumors of potential cooperation with Intel.

Previous reports had suggested that TSMC and Intel were in preliminary talks to establish a joint venture to co-manage Intel’s U.S. fabrication facilities, with TSMC potentially holding a 20% stake in the new entity. However, TSMC’s latest statement clarified that the company is not involved in any such collaborative plans.

Additionally, TSMC noted that although the U.S. government has imposed tariffs on imported goods, these have not yet impacted customer behavior, and the company remains optimistic about its revenue outlook for 2025.

In summary, TSMC has explicitly denied any negotiations with Intel regarding joint ventures or technology partnerships and reaffirmed its commitment to focusing on its own business growth.

*

Click the share button below to email/forward this article. Follow us on Instagram and X and subscribe to our Telegram Channel. Feel free to repost Global Research articles with proper attribution.

All images in this article are from the author

Global Research is a reader-funded media. We do not accept any funding from corporations or governments. Help us stay afloat. Click the image below to make a one-time or recurring donation.

Comment on Global Research Articles on our Facebook page

Become a Member of Global Research

Source link